MUTUAL FUND

Mutual funds are becoming the most popular investment vehicles for those who want to invest in Equity / Debt market indirectly through professionally management.

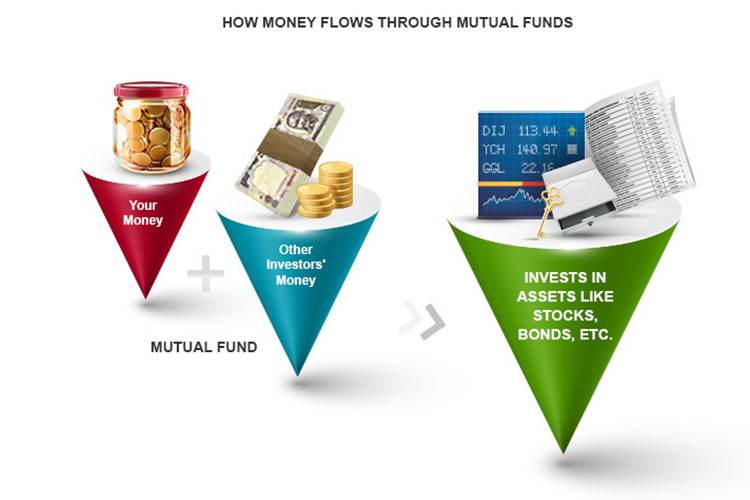

Mutual fund is an investment that pools money from many investors to purchase securities such as stock, bonds, fixed income funds, equity and other assets.It is a trust that collects money from a number of investors who share a common investment objective. Then, it invests the money in equities, bonds, money market instruments and/or other securities. Each investor owns units, which represent a portion of the holdings of the fund. The income/gains generated from this collective investment is distributed proportionately among the investors after deducting certain expenses, by calculating a scheme.When an investor buys Apple stock, he is buying part ownership of the company and its assets. Similarly, a mutual fund investor is buying part ownership of the mutual fund company and its assets. The difference is Apple is in the business of making smartphones and tablets, while a mutual fund company is in the business of making investments.Primary structures of mutual funds include open end funds, unit investment trusts, and closed end funds. Exchange traded funds are open end funds or unit investment trusts that trade on an exchange. Mutual funds are also classified by their principal investments as money market funds, bond or fixed income funds, stock funds or equity funds, hybrid funds or other funds. Funds may also be categorized as index funds, which are passively managed funds that can match the performance of an index, or actively managed funds.

Advantages of investing through mutual funds:-

- Variety of schemes to invest based on individual risk appetite.

- Easiest and convenient way of making successful investment.

- Discipline of regular savings through SIPs.

- Getting a professional to invest funds on your behalf.

- Economies of Scale.